Hello! It’s konkaz (@konkazuk) here.

In this article, I will introduce “SETTING UP AND RUNNING A LIMITED COMPANY,”

a book written by Robert Browning, to those who are interested in understanding how to start a company and progress with their business endeavors in the UK.

You probably can find the methods of starting a company through online searches easily, but for those who prefer a thorough understanding by reading a physical book and want to grasp the essentials in English, this book comes highly recommended.

By the way, as it is being mentioned in the introduction of the first chapter, this book is not intended to be a guide that supports them in starting a business.

This book is intended for those who are already involved in business, meaning you have existing commercial products or services, to assist with their future operation and management.

Anyway, please have a look.

Is a “company” the right structure for your business?

Firstly, the 1st chapter begins with addressing whether structuring your business as a “company” is truly suitable for you.

Here, the differences between adopting a form of individual ownership or partnership, and adopting the form of a company, are laid out side by side, making it very easy to understand.

There are also clear explanations of the important points, if you choose to buy an already existing company and become the owner, so this is quite helpful.

It is also mentioned that many individuals set up the company with unwarranted confidence, such as thinking “I believe I will be able to manage somehow.” or relying on luck. What about you?”

It is also written that seeking advice from professionals before starting is ultimately safer, with some details provided on where and what kind of advice you should seek.

Conversely, the advantages of choosing a partnership structure are also clearly outlined here. This means that, before settling on the “company” form, it’s better for you to carefully consider both options and then decide which one you should go for.

Setting up your Company

So, from the 2nd chapter onwards, the content is for those who have decided to start their own company.

To begin with, in the case of a partnership, business debts become the responsibility of each individual partner, and if one of the partners died, the partnership would dissolve.

On the other hand, in the case of a company, the company’s debts are its liabilities. If something goes wrong in the business, legal actions would be directed at the company. Furthermore, even if a co-founder of the company were to pass away, the company’s existence would continue.

Since the company itself becomes a distinct entity, the responsibility (liability) of the company is “limited” to the company itself and does not extend to individuals.

Therefore, you should keep the following in mind…

In your business dealings, it is not you that is dealing but you on behalf of your company.

And then, the rest are detailed explanations about the procedures for actually registering the company.

⚪ Considerations when choosing a company name

⚪ Issuance and distribution of shares

⚪ How to deal with Articles of Association

⚪ Roles of company directors and secretaries

⚪ What information to provide to Companies House

Above matters are written alongside actual registration screen images, making it quite clear and user-friendly.

As you progress through these explanations and reach the 4th chapter, you’ll find instructions for completing the application forms.

(Chapter four consists entirely of copies of application forms on each page.)

What to do after setting up your company…

Once you’ve launched your company and taken a breather, this is where the real work begins.

There are things awaiting you that you need to learn.

For instance, if you are a sole trader, since there is no clear boundary between your business and personal matters, it’s okay to withdraw money from your bank account when you need it. However, with a company, it’s not as straightforward.

When company directors pay themselves their salary, the basic structure is similar to how it works for their employees. However, if they were to withdraw some money from company’s revenue, taxes wouldn’t have been accounted for in that transaction. Hence this is illegal.

It is prohibited by law for a company to lend money to its directors!!!

Since you are the one running the company, it’s easy to confuse the money you have earned in the business as your own, but the company’s money belong to the company.

Furthermore, it’s advisable to consider the amount of salary you pay yourself carefully, as there’s a possibility that a substantial amount of taxes might be incurred later. Therefore, it is recommended to seek advice from an accountant to make this decision.

In addition, you can acquire fundamental knowledge about the topics listed below.

⚪ Shareholders’ rights

⚪ Distribution of dividends

⚪ Responsibilities and duties of company directors

⚪ Submission of accounts

⚪ Considerations when opening a business bank account

⚪ Points to note when employing staff

I was personally impressed by the 8th chapter, which discusses the significance of accounting, and the 11th chapter titled ‘Troubleshooting.’

I used to keep a household budget for about five years. I remember there were times when I skipped doing it for three days or even a week, which was appalling. As a result, I would struggle to recall what happened, dealing with a mountain of receipts.

When it comes to a limited company, taxes and other matters come into play. Eventually, you have to submit records to the authorities, so this kind of approach won’t work. w

Accounting directly reflects the health of the company, therefore it’s crucial to handle it with care in order to spot areas for improving your business.

Moreover, there are quite a few people who find themselves in a situation of having no money when it’s time to pay taxes. Therefore, let’s run the business while saving money wisely.

Additionally, there are various expert advice on strategies for collecting money from reluctant payers, winding down a company, and more. Practical aspects like handling the “PAYE” system, which I haven’t yet explored, seem challenging to grasp just from reading. So, I guess this is the kind of thing that you have to check as you go along and gain experience…

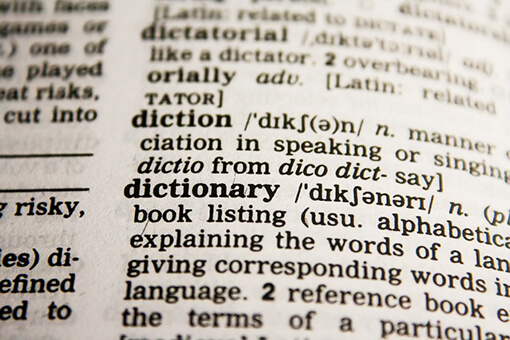

Related vocabulary

Lastly, I’ll compile useful English vocabulary related to setting up a company that you can keep in mind.

🔹association

a group of people who work together in a single organization for a particular purpose

🔹Memorandum of Association

a short note designating something to be remembered in business

🔹Articles of Association

a document that specifies the regulations for a company’s operations and defines the company’s purpose

🔹company director

someone who sits on the board of a company

🔹minutes [aka minutes of meeting]

notes that are recorded during a meeting

🔹resolution

an official decision that is made after a group or organisation has voted

🔹chairman

an executive elected by a company’s board of directors who presides over board meetings and works to build consensus in board decisions.

🔹registered office

the official address of an incorporated company, association or any other legal entity

🔹company formation agent

an independent company that incorporates (registers) companies on behalf of new businesses, making the process quick, simple, and considerably affordable. Formation agents enable people to easily set up various types of company structures entirely online

🔹Companies House

the executive agency of the British Government that maintains the register of companies, employs the company registrars and is responsible for incorporating all forms of companies in the United Kingdom

🔹incorporation

the process by which a new or existing business registers as a limited company

🔹corporation

a legal entity that is distinct from its owners

🔹certificate of incorporation

a legal document that shows you’ve formed and registered your limited company with Companies House

🔹UK SIC [Standard Industrial Classification] code

a five-digit classification providing the framework for collecting and presenting a large range of statistical data according to economic activity

🔹share capital

the amount of money the owners of a company have invested in the business as represented by common and/or preferred shares

🔹subscribe

to formally ask to buy particular shares when they are issued

🔹subscriber

someone who formally asks to buy shares when they are issued

🔹nominal value = face value

value measured in terms of absolute money amount

🔹real value

considered and measured against the actual goods or services for which it can be exchanged at a given time

🔹annum

per annum = per year

🔹liquidation

The process of selling off assets and using the proceeds to pay off creditors and shareholders

🔹a liquidator

a person with the legal authority to act on behalf of a company to sell the company’s assets before the company closes in order to generate cash for a variety of reasons including debt repayment.

🔹annual return

a document that companies had to file at Companies House each year on the anniversary of the company’s incorporation. The annual return was replaced by the “confirmation statemen in 2016.

🔹confirmation statement

The statement that confirms your basic company information is correct and up to date.

🔹accounting reference date [ARD]

The final day of your company’s financial year – and the date that your annual accounts must be made up to. It is automatically set by Companies House as the anniversary of the last day of the month of company incorporation.

🔹small companies

According to the Companies Act 2006 in the UK, a company is considered “ if it meets at least two of the following criteria:

1. Turnover not more than £10,200,000

2. Balance sheet total not more than £5,100,000

3. Average number of employees not more than 50

🔹directors’ report

a document that provides an overview of a company’s operations, financial performance, and prospects

🔹balance sheet

a financial statement that contains details of a company’s assets or liabilities at a specific point in time.

🔹registrar

an official whose job is to keep official records

🔹gross

a total amount of money before tax or other contributions, etc. is taken off

🔹net

the profit that remains after all expenses and costs have been subtracted from revenue.

🔹audit

a formal examination of an organization’s or individual’s accounts or financial situation

🔹creditor

the one to whom a debt is owed

🔹debtor

a company or individual who owes money to a lender

🔹PAYE [Pay As You Earn]

the system your employer or pension provider uses to take Income Tax and National Insurance contributions before they pay your wages or pension.

🔹income tax

a tax you have to pay on your income

🔹corporation tax

the main tax that a limited company must pay

🔹Employer Annual Return

a report that companies must send to the government each year giving particular details, such as the names of company directors, details of assets and shares

🔹writ

a legal document that orders a person to do a particular thing

🔹capital gains tax

a tax on the profit you earn when you sell an asset that has increased in value

In order to get deeper knowledge of each topic, it’s essential to search for books or relevant websites that focus on those specific areas. However, for gaining fundamental knowledge about starting a company in the UK, I found this book to be incredibly clear and informative.

For those who are interested, you can purchase it from here. 👇

Well, this is it.

Bye now!

konkaz

You can read this blog post in Japanese from the link below.

👉 ビジネスを一歩進める:ロバート・ブラウニングの『Setting Up and Running a Limited Company』のエキスパートアドバイス